Insurer Tender Management

Overview

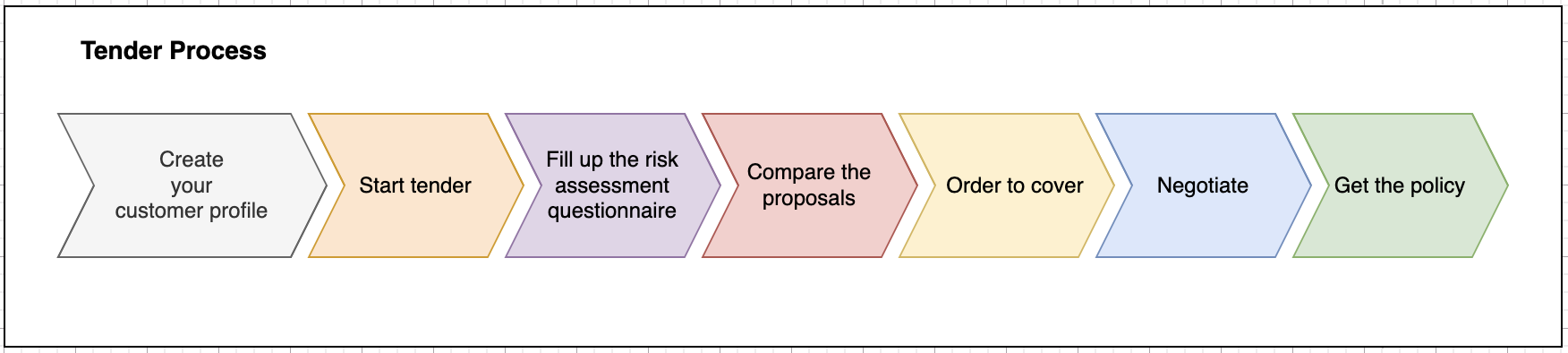

Tender is the key process to acquire new businesses which are initiated by a Broker for a specific customer and specific product in a certain line of business. Customers are required to fill up a risk assessment questionnaire and submit it to receive offers from one or more insurance companies.

Finlex tender process is designed to enable Insurance Brokers to better serve their customers from the risk assessment and onboarding of the customer till the generation of the policies and finalizing the contracts. While the customers are able to directly interact with the system to fill in questionnaires, in general system is designed to serve brokers and insurers.

The broker as a representative of the customer acts as the initiator of the tender request and interacts with Finlex and Insurance companies to get the best deal for the customer.

Insurers are acting as the providers of the chosen Insurance Product and are serving the offers to be shared with the customer. Insurers are not able to see each other's offers and are able to only access their own information.

Start a TenderTender requests are started by Broker accounts.

Workflow

Features

The list of features you have as an insurer in Tender Management are as below,

- Pre-Configure the underwriting reactions to the identified risks in risk assessment. This feature will help the Finlex platform to know your reactions and prepare the initial proposal based on customer information and risk assessment on behalf of the Underwriter.

- Be notified when a broker submits an order to cover

- Negotiate with the broker in the Finlex platform

- Request for reservations

- Edit the generated offer

- Finalize the order to cover and issue the policy and contract

- Preliminary covernote in case some reservations are yet to be provided by the customer

Updated 10 months ago