Broker API Overview

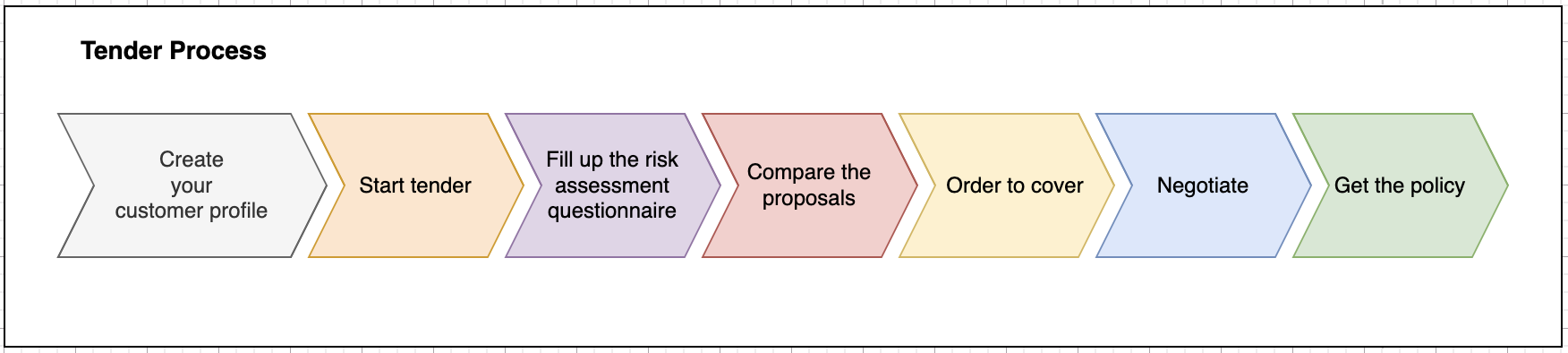

Tender is the key process to acquire new businesses which are initiated by a Broker for a specific customer and specific product in a certain line of business. Customers are required to fill up a risk assessment questionnaire and submit it to receive offers from one or more insurance companies.

Finlex tender process is designed to enable Insurance Brokers to better serve their customers from the risk assessment and onboarding of the customer till the generation of the policies and finalizing the contracts. While the customers are able to directly interact with the system to fill in questionnaires, in general system is designed to serve brokers and insurers.

The broker as a representative of the customer acts as the initiator of the tender request and interacts with Finlex and Insurance companies to get the best deal for the customer.

Insurers are acting as the providers of the chosen Insurance Product and are serving the offers to be shared with the customer. Insurers are not able to see each other's offers and are able to only access their own information.

In addition to the reference docs, the following resources are available:

- How to onboard a new customer

- How to start a new tender

Tender overall workflow

Features

Here is the list of features you have as a broker in Finlex Tender Management:

- Create new customer

- Start a new tender for your customer

- Uniform risk assessment questionnaire instead of an individual questionnaire for each insurer.

- Hassle-free tender proposals in a few seconds

- Review and compare the proposals from multiple insurers

- Access to risk score and risk analysis including expert tips

- Upload the requested reservations and negotiate with Underwrites

- Submit the order to cover online

- Send the documents to your customer for digital signature (coming soon)

- Access to covernote issued by the insurer

- Seamless integration with contract management and policy management modules to trigger automatic policy and contract creation in the event of a final covernote issued by the insurer.

- the record-keeping and audit trail of changes

- Document and file management in order to organize and maintain access to the documents uploaded by you (Broker) and insurers and

- Access to sales support materials provided by Finlex experts (coming soon)

- Setup a customized sales landing page to open the sales gate to your potential/customers

Updated 10 months ago